Invest With Purpose. Earn Above-Market Cash Flow.

Restorative Real Estate™ Investor Pathway

Turn a single-family home into 8–12 income streams—while providing life-changing housing for people in recovery. Join thousands of forward-thinking investors leveraging our proven strategy to unlock 15%+ cap rates in today's tight market.

Why Investors Need Restorative Real Estate Right Now

1. The Numbers No One Tells You

| Typical Austin SFR Rental | Restorative Home (Per-Bed Model) | |

|---|---|---|

| Median purchase price (Mar 2025) | $548K | same house |

| Mortgage (20% down @ 6.7%) | $2,839 / mo | — |

| Taxes & insurance (est.) | $1,100 / mo | — |

| Total carry cost | $3,939 / mo | — |

| Avg 3-bed house rent | $1,900 / mo | — |

| Cash flow | -$2,039 / mo (loss) | $7,200–10,800 / mo gross (8–12 beds × $900) |

Outcome: Traditional rentals bleed red ink. A Restorative Home can 3-4× gross revenue—turning a monthly loss into $2-4K net profit without speculative appreciation.

2. Pain Points Crushing Landlords in 2025

- High Interest Rates:30-year fixed still hovers near 6.7%—doubling debt cost vs. 2021.

- Rising Property Taxes:Texas school-tax collections jumped 6% last year despite headline "cuts".

- Softening Rents:Average Austin rents fell $375 YoY as new supply hits the market.

- Insurance & Maintenance Spikes:Premiums up >15% statewide; HVAC parts up 22%.

- Cap-Rate Compression:Class-A rentals trade at 3–4% yields—below inflation.

3. How the Restorative Model Flips the Script

| Feature | Benefit |

|---|---|

| Per-bed leases (8–12 tenants) | 200–300% higher gross income, diversified against single-tenant vacancy. |

| Multi-year operator contracts | Predictable cash flow; tenant turnover handled by the operator, not you. |

| FHA / ADA protection for recovery homes | Municipalities cannot ban the use, safeguarding long-term viability. |

| Mission-aligned demand | 23 million Americans in recovery; occupancy stays >90% even in recessions. |

| Hands-off management | Operator handles staffing, compliance, and house rules—true passive ownership. |

| Counter-cyclical stability | Recovery housing demand rises during economic downturns, hedging portfolio risk. |

| Equity + Cash Flow | Capture Austin's long-term appreciation and earn double-digit cap rates today. |

4. Investors Using Traditional Rentals Face

- ❌Negative Cash Flow: Paying $24-30K per year out-of-pocket waiting for appreciation.

- ❌Regulation Risk: Growing rent-control chatter in TX metros.

- ❌Liquidity Squeeze: High rates limit refinance exits; buyers demand yield.

- ❌Tenant Default Headaches: Eviction moratorium echoes loom whenever the economy wobbles.

5. Investors Using Restorative Real Estate Gain

- ✅Immediate Positive Cash Flow – often $24-40K net in year 1.

- ✅Social Impact Halo – capital that heals communities, enhancing PR & lender relations.

- ✅Recession-Resilient Asset – demand tied to healthcare & recovery, not luxury consumer spending.

- ✅Scalable Blueprint – rinse-and-repeat with our operator network or graduate to our Turnkey Concierge.

Bottom Line: In 2025's high-rate, low-yield market, Restorative Real Estate is one of the few strategies that restores double-digit returns without gambling on short-term rentals or speculative flips.

Lock in this edge before the crowd rushes in.

Why Traditional Rentals Fail in 2025

The average $550K rental in hot markets loses $500-$800 every month

Class-A rentals in growth cities hover at 3-4% returns

Inventory crunch drives up acquisition prices, not profits

The Untold Strategy

Our Restorative Real Estate model re-positions the same property as a professionally-run recovery residence—legally protected under the Fair Housing Act—creating multiple per-bed revenue streams and multi-year operator leases.

Result? 2-3× higher gross rent and a mission that matters.

What You Get for $27/Month

Swipe through our comprehensive resource vault that makes launching your first recovery residence straightforward and profitable.

Furnishing Blueprint

Outfit a 12-bed home for $0 out of pocket using our donation & liquidation playbook.

Bulk Shopping Lists

Exact SKUs for beds, fridges, linens & cleaning supplies—plus vendor discounts.

Hiring & Firing Manual

Job posts, interview scripts, 30-day scorecards for house managers.

Manager Training Mini-Course

6 modules with quizzes & printable certificates.

Resident Contract Vault

Attorney-drafted house rules, leases, ADA compliance letters.

Expense-Crusher Toolkit

Utility-optimization cheats & insurance brokers who get recovery housing.

Deal Calculator & Weekly Digests

Plug-and-play spreadsheet + fresh MLS leads delivered every Friday.

Private Skool Community

Ask questions, share wins, attend monthly live Q&A with our founders.

Founding-Member Guarantee: Lock in $27/mo for life. Cancel anytime—no hard feelings.

Your 5-Step Blueprint to 15%+ Returns

- 1️⃣

Acquire

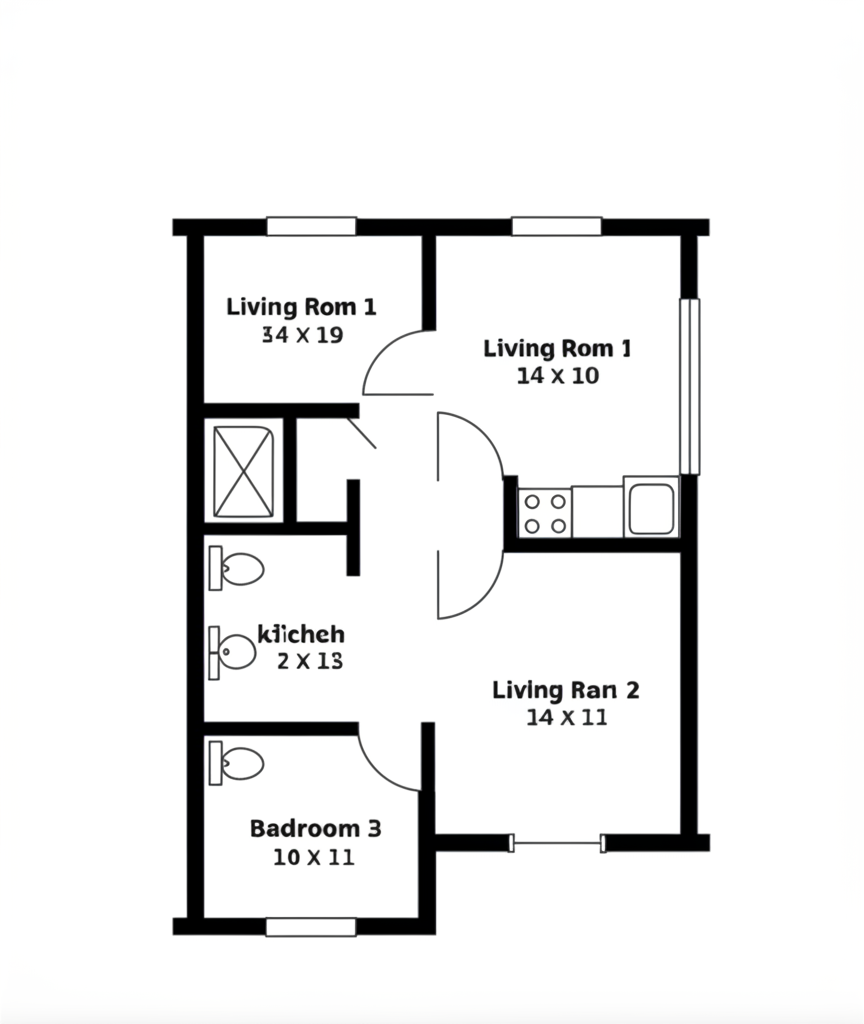

Target 4–5 BR, 2–3 BA, 2,000–3,000 sq ft homes in residential zones nationwide.

- 2️⃣

Configure

Follow our 14-point Reno & compliance checklist (egress, sprinklers, keyed doors).

- 3️⃣

Staff

Hire, train, and onboard a live-in manager in under two weeks.

- 4️⃣

Stabilize

Fill beds to 95% occupancy via our referral network & marketing templates.

- 5️⃣

Scale

Duplicate the model—or choose our Turnkey Concierge and let us build it for you in Central Texas—America's hottest real estate market. (Turnkey option exclusive to Insider-Club members.)

Founding-Member Offer

Insider-Club Access • $27/Month

- Full Resource Vault

- Private Skool Community & Live Calls

- Per-Bed Deal Calculator & MLS Digest

- $1,000 Concierge Credit toward any future turnkey project in Central Texas

30-day money-back promise • Zero risk

Investor Wins

Closed my first Restorative Home in 90 days—netting $2,400/mo after debt service.

– Mike S., Houston TX